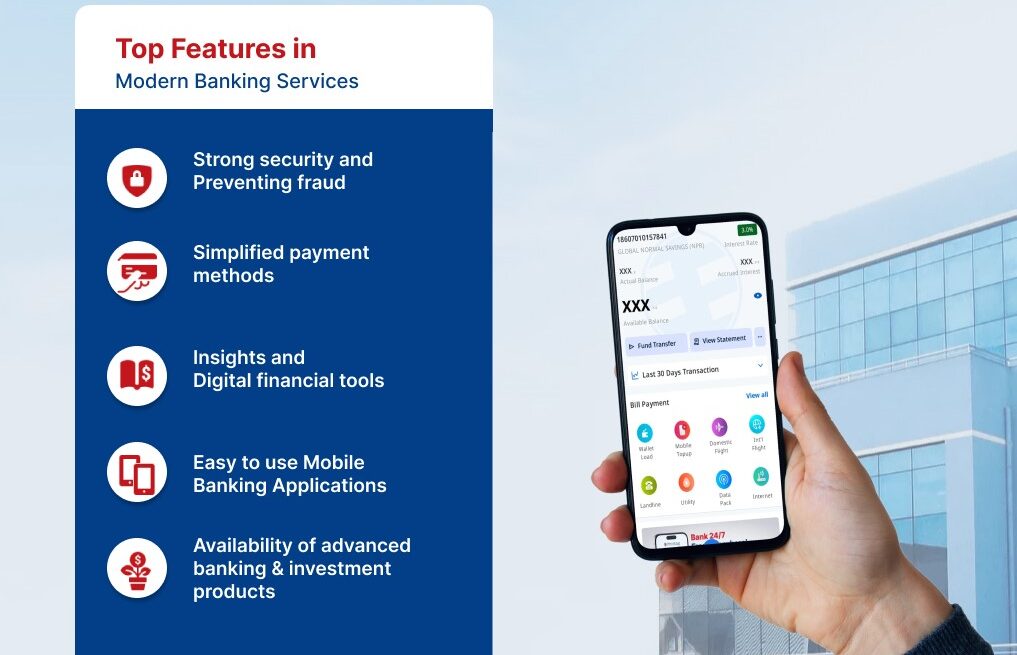

Recent years have seen a dramatic change in the banking industry, driven by both shifting consumer expectations and technological breakthroughs. Customers of modern banks demand smooth, effective, and creative solutions catered to their financial needs, not just a secure location to keep their money. Here, we look at the top five qualities that consumers value most in banking services nowadays.

Strong Security and Preventing Fraud

In the era of online banking, strong security protocols are essential. Consumers want to know that their money and financial information are protected from online attacks. Customers cannot compromise on security because of the numerous threats connected to internet banking, which include phishing, malware, and identity theft.

Some of The Major Important Security Features That Customers Appreciate:

Encryption of Information: Sensitive information is kept secret throughout transactions thanks to end-to-end encryption.

Multi-Factor Authentication: By asking users to confirm their identity using several different means, including passwords and biometrics, multi-factor authentication (MFA) adds an additional layer of security.

Real-time fraud alerts: Customers can take prompt action and feel more at ease when they receive notifications of questionable account activity.

User education: To assist clients in identifying and avoiding frauds, a lot of banks now provide guides or advice.

In order to prevent safety procedures from degrading the user experience, modern banks must strike a balance between security and usability.

Easy-to-use Mobile Banking Applications

The way that consumers engage with their banks has changed as a result of the smartphone revolution. These days, a well-designed mobile banking app is an essential tool that helps users complete financial tasks quickly and easily.

Qualities That Make a Great Mobile App:

Personalized Dashboards: Apps that let users quickly view account balances, transactions, and spending trends are known as personalized dashboards.

Payments using QR codes: Makes money transfers and regular purchases easier.

Seamless integration with third-party services: Compatibility with payment platforms, e-commerce sites, and digital wallets enriches the app’s functionality.

Cardless ATM withdrawals: Using QR codes or near-field communication (NFC) technology to withdraw money without a physical card.

Banks that prioritize user-friendly navigation and seamless operation give their customers a fun and reliable experience.

Insights and Digital Financial Tools

The scope of contemporary banking services is expanding beyond simple financial transactions. Consumers now anticipate that banks will assist them in efficiently managing their finances by providing digital solutions that reveal information about their spending patterns.

Frequently Used Financial Instruments:

Expense tracking: Provides users with a clear picture of their spending patterns by classifying transactions.

Automated Smart Saving Plans: features that direct money toward particular savings objectives, such emergency savings or vacation funds, are known as smart savings plans.

Track financial transactions and budgets: apps that recommend spending caps based on user income and historical spending patterns are examples of budgeting aids.

These characteristics turn banking apps into essential resources for handling personal finances by enabling users to make knowledgeable financial decisions.

Simplified Payment Methods

A key component of contemporary banking is the availability of quick and dependable payment solutions. Consumers value banks that offer easy, quick, and flexible bill payment and money transfer services.

Features of Preferred Payments:

Peer-to-peer (P2P) payments: These remove the need for account information by allowing users to send money directly to others using usernames, email addresses, or phone numbers.

Regular payments for bills: Essential payments, including loans and utilities, are never missed because to automation.

Instant transfers: Clients can access or move their money whenever they need it thanks to real-time financial transfers.

Simplifying payments increases consumer loyalty and trust in addition to convenience.

Availability of Advanced Banking and Investment Products

Customers are looking for banking services that go beyond simple account management as they grow more financially aware. Access to sophisticated financial products and investment possibilities is now required of modern institutions.

Value-Added Service Examples: Customers can invest in stocks, bonds, and mutual funds straight from their banking app thanks to digital investment platforms.

Support for cryptocurrencies: In response to the increased demand for digital assets, some institutions now provide tools for buying, selling, or storing cryptocurrencies.

Multi-currency wallets: Perfect for companies that conduct business internationally and for regular travelers.

BaaS, or banking as a service: platforms that let clients personalize their banking experiences, like combining several financial instruments inside a one account.

By presenting themselves as financial partners rather than as service providers, these characteristics help banks build closer bonds with their clients.

In conclusion

Customer desire for services that put ease, security, and personalization first is driving the evolution of banking. Modern banking services are built on a foundation of innovative banking products, digital financial instruments, user-friendly mobile apps, secure security procedures, and expedited payments.

In addition to meeting consumer expectations, banks that adjust to these developments establish themselves as progressive organizations prepared to compete in the rapidly evolving financial market. One thing is certain as technology develops further: providing outstanding customer-centric experiences is where banking is headed. Because of the advance and latest features, Global IME Bank has established itself as a leading financial institution in Nepal. Besides, the bank is also partnering with partners to offer the best experience. Recently, the bank partnered with Tigg to integrate bank feed and provide the best accounting software experience in Nepal, the task was made possible using Global IME Bank’s modern & robust open banking infrastructure.